Payment Processing

How to Accept DAFpay Donations

Allow donors to make donations online via their donor-advised fund.

Updated 10 hours ago

Use the guide below to learn how to accept DAF donations on your 4aGoodCause donation pages.

What is a DAF?

A donor-advised fund (DAF) is a type of charitable investment account that allows donors to contribute cash or non-cash assets (like mutual funds, cryptocurrency, or publicly traded securities) and receive an immediate tax deduction.

Those funds can then be granted to IRS-qualified nonprofits over time—whenever the donor is ready.

What is DAFpay?

DAFpay is the world's first donor-advised fund payment option, allowing donors to recommend a grant to any cause in just 3 clicks, directly on a nonprofit's donation form.

DAFpay was created by Chariot to simplify the DAF fundraising process for donors and nonprofits. This means more frequent and bigger gifts from donors and less headaches tracking and processing DAF gifts for nonprofits.

Watch the video below for more information on DAFs and a demo of how DAFpay works on 4aGoodCause.

Learn more: DAFpay for Nonprofits: How to Accept Donor-Advised Fund Gifts Online

Can all nonprofits on 4aGoodCause use DAFpay?

DAFpay is only for U.S. 501(c)(3) nonprofits or IRS-recognized public charities. This includes groups like national relief organizations, schools, religious groups, and food banks with IRS tax-exempt status or those seen as public charities by law.

Some exceptions are places of worship (churches, synagogues, mosques) that haven’t applied for 501(c)(3) status. Each DAF provider has its own rules for these cases.

DAFpay and Chariot do not support 501(c)(4) organizations or private foundations.

Important: Nonprofits that wish to use DAFpay on 4aGC must also have a valid EIN entered into their business information. This is how you will be identified by DAFpay. If your EIN is incorrect or missing, please reach out to support@4agoodcause.com.

Can we use DAFpay for all our online payments?

No. DAFpay can only be used to make donations, one-time or monthly.

DAFs can’t be used for anything that provides a personal benefit to the donor.

That includes things like:

Event tickets or auction items

Memberships with perks

Raffle entries

Goods or services of any kind

When DAFpay is enabled on 4aGoodCause, it will only appear on your donation pages.

What is the minimum DAF donation amount?

The minimum amount depends on the DAF provider, usually between $20 and $250 or more. If a donor enters less than the minimum, the amount can be adjusted up by the donor.

Is there a cost to use DAFpay?

There are no platform fees from 4aGoodCause to enable DAFpay.

Chariot charges a 2.9% fee for processing DAF donations. How you pay this fee depends on whether you have claimed your Chariot account (see below).

How will my nonprofit receive funds from DAFpay donations?

If the nonprofit has claimed a Chariot account:

The DAF provider sends the full donation directly to the nonprofit, usually by check (or ACH if set up).

The donation comes with a Tracking ID for easy payment tracking.

At the end of each month, Chariot bills the nonprofit a 2.9% fee using the payment method on file.

Learn more: How will my organization receive gifts from DAFpay?

If the nonprofit has not claimed a Chariot account:

The donation is sent by the DAFpay Network, with a check for the donation amount minus the 2.9% fee.

The check goes to the nonprofit’s address on file with the IRS.

Learn more: What is the DAFpay Network's check issuance policy?

When DAFpay is enabled on 4aGoodCause, your nonprofit will receive an email from Chariot allowing you to claim a Chariot account. We recommend doing this to have the most seamless DAFpay experience.

Learn more: Chariot Deposit Accounts

What if the grant request is denied or I don’t receive my donation?

If a request is denied, DAFpay refunds the processing fee. If you don’t get your donation, contact Chariot at dafpay@givechariot.com.

How to enable DAFpay on 4aGoodCause

You should find DAFpay already enabled, but it's not please follow these steps.

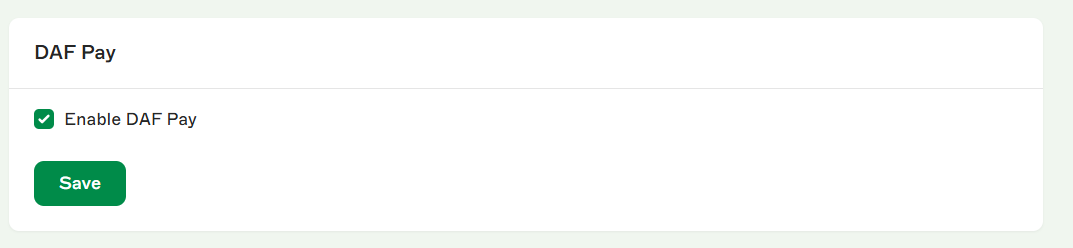

Step 1 - Enable it for your account.

Log in to 4aGoodCause at https://4agc.com as a Nonprofit User.

Click on Settings on the left menu.

Click Payment Gateways on the left menu.

Check the box labeled Enable DAF Pay.

Click Save.

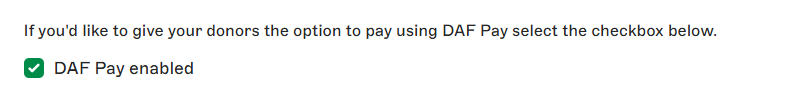

Step 2 - Enable the option on your campaign

Log in to https://4agc.com as a Nonprofit User.

Click on Campaigns on the left menu.

You will be presented with a list of your current campaigns.

Click the Menu icon on the right for the campaign you need to edit.

Select Edit from the menu.

Scroll down to Payment Options and check the box labeled DAF Pay enabled.

Scroll down to the bottom of that page to click the button to Update that aspect of the campaign.

Click < Campaigns on the top left to return to the list of your campaigns.

Should you need to disable DAFpay, please follow these same steps and uncheck the checkbox, and click Save.

Viewing DAF donations in your Donations report

DAF donations will appear in your Donations report just like any other donation.

To access this report, click on Donations on the left menu in the 4aGoodCause admin.

You will see the payment method on these donations noted as "Donor Advised Fund".

You will also see a field called External Grant ID. External Grant ID is the unique donation identifier provided by the DAF provider.

The Transaction ID on the 4aGC record should match the Tracking ID for the gift with Chariot.

Please note that when thanking donors for this donation, they have already received their tax benefit at the time the funds were placed in their DAF, not when they granted the gift to you.

How to add future, recurring, monthly DAF donations to 4aGoodCause

4aGoodCause supports recurring, monthly DAF donations, but will only receive the first donation electronically. As you receive future monthly grant disbursements, you can manually enter those donations into the donor's recurring giving subscription. This will help the donor get a record of all gifts in their donor account and will help your nonprofit keep track of gifts received.

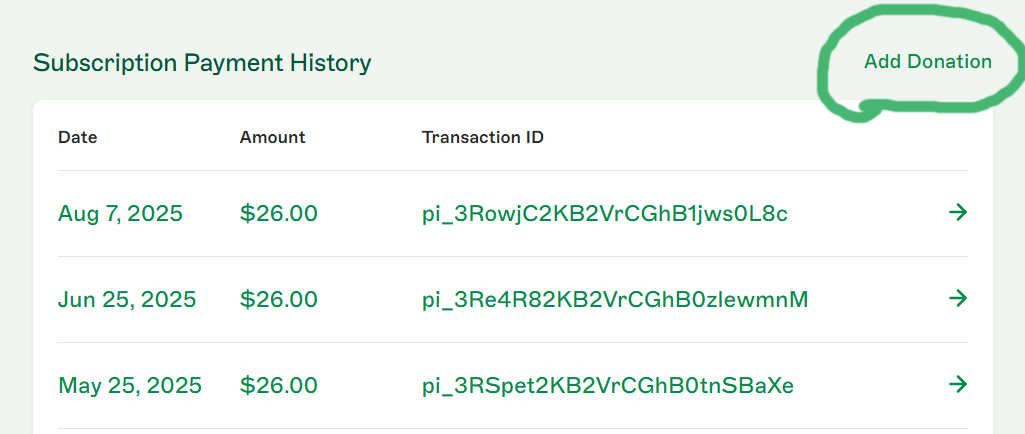

To enter future, recurring, monthly DAF donations to 4aGoodCause, follow these steps.

Log in to https://4agc.com as a Nonprofit User.

Click Subscriptions in the main left-side menu.

Find the subscription by using the search box. You can search by name or subscription ID.

Click the row of the subscription.

Click the three-dot Menu icon on the right.

Select Edit.

Scroll down to Subscription History

Click Add Donation

This will load the donation into our Add Donation form.

Complete the form. Make sure to choose Donor Advised Fund as the payment method and enter the Transaction Date (when the gift was received),

Click Create Donation.

How to update or cancel a recurring, monthly DAF donation

Should a recurring DAF donor wish to update or cancel their recurring DAF gift, please have them contact their DAF provider directly to make those changes.

You cannot change the amount or cancel a recurring DAF donation inside 4aGC.

If you know a donor has updated or canceled a DAF gift, you can update the 4aGC subscription record to reflect the changes. See this guide on editing subscriptions in 4aGC.

Have more questions about DAFpay?

Visit the Chariot Help Center or reach out to us at support@4agoodcause.com.